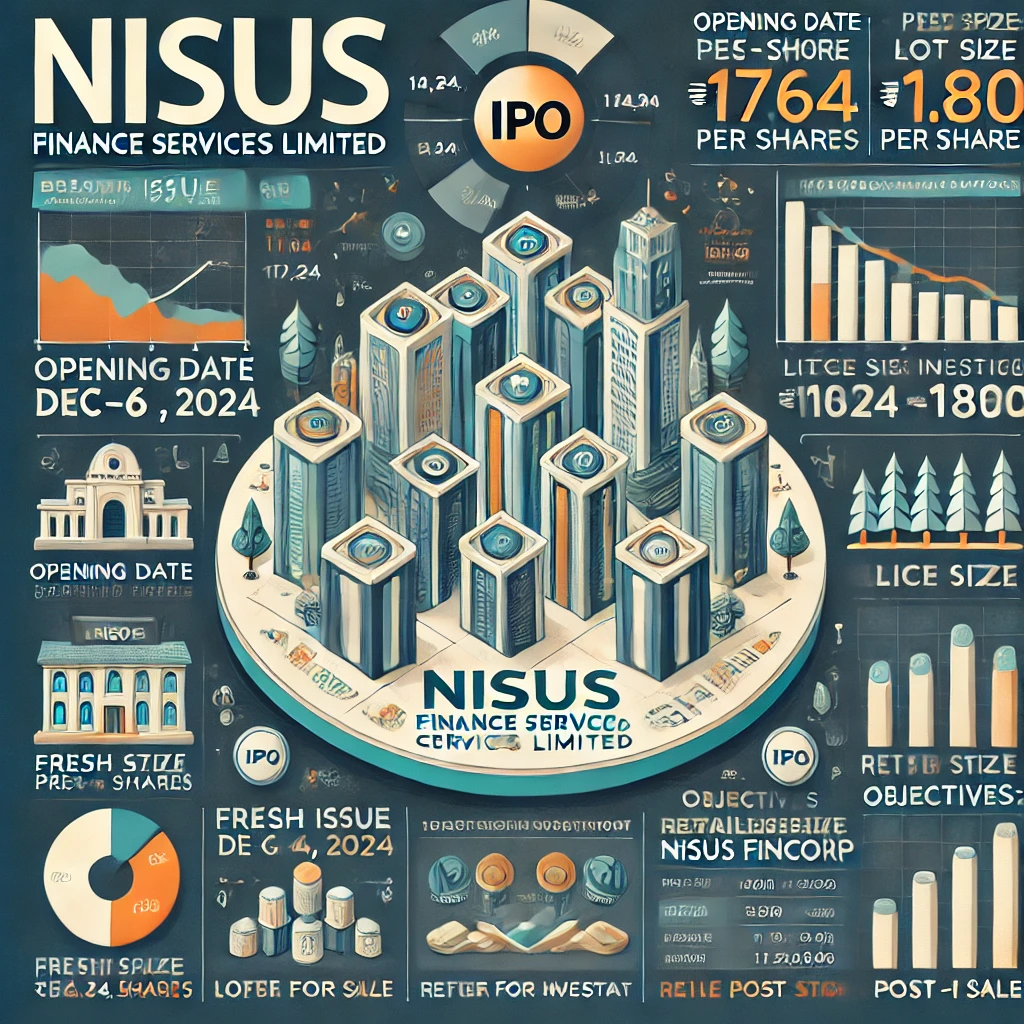

Nisus Finance Services IPO is one of the most anticipated IPOs in the financial services sector, and investors are eagerly awaiting its subscription dates and potential listing. With a fresh issue size of ₹101.62 crores and an offer for sale of ₹12.61 crores, the Nisus Finance Services IPO promises to offer significant opportunities for retail and HNI investors. Below is a breakdown of the key details regarding the IPO dates, GMP of SME IPO, and essential insights into IPO finance.

Table of Contents

Nisus Finance Services IPO Dates

The Nisus Finance Services IPO opens for subscription on December 4, 2024, and closes on December 6, 2024. Investors must be aware that the IPO dates are crucial for submitting applications within the prescribed window. The allotment is expected to be finalized on December 9, 2024, with a listing date scheduled for December 11, 2024, on the BSE SME platform.

Understanding the GMP of SME IPO

The GMP (Grey Market Premium) is a vital indicator of the IPO’s market sentiment. For investors looking to explore SME IPOs, the GMP of SME IPOs can provide an early glimpse into the potential listing gains. While the GMP of Nisus Finance Services IPO will evolve closer to the opening date, understanding the GMP of SME IPOs in general can offer useful insights. A higher GMP typically signals strong demand and positive investor sentiment towards the IPO.

For instance, Prudent Corporate Advisory Services Ltd IPO GMP is a good example of how the market reacts to strong IPOs. Tracking these trends can guide investors in making informed decisions about their IPO subscriptions.

Key Financial Insights and IPO Finance

When evaluating the Nisus Finance Services IPO, it is essential to consider its financial health and long-term growth potential. IPO finance refers to the funding process through which companies raise capital by offering shares to the public. Nisus Finance Services, with an AUM (Assets Under Management) of approximately ₹1,000 crore, has shown impressive financial growth, with revenue increasing by 266.16% and profit after tax (PAT) rising by 663.29% from FY 2023 to FY 2024.

This growth trajectory is a critical factor that investors should assess when considering the IPO’s viability. Additionally, the IPO finance structure includes a mix of fresh issues and offer for sale, making it an attractive proposition for both retail and institutional investors.

Nisus Finance Services Day-wise IPO GMP Trend

Live Subscription Data check

Click HereConclusion

The Nisus Finance Services IPO is set to make a significant impact on the market, with promising financials and growth potential. As the IPO dates approach, investors should stay updated on the GMP of SME IPOs and leverage IPO finance insights to make informed investment decisions. With the IPO opening on December 4, 2024, and closing on December 6, 2024, it’s important to watch the market closely for any signals regarding the GMP of Nisus Finance Services IPO and adjust strategies accordingly.

Stay tuned for further updates as we approach the opening date and ensure you’re prepared for this exciting investment opportunity.